Conventional loan calculator how much can i borrow

Loan limits for conforming conventional loans are set by the FHFA. How much income you need depends on your down payment loan terms taxes and insurance.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

. How expensive of a home can I afford with an. We recommend choosing a 15-year fixed-rate conventional loan. With a 20 down payment on a 30-year mortgage and a 4 interest rate you.

Ad Try Our 2-Step Reverse Mortgage Calculator. How much to put down. Calculate how much house you can afford with our home affordability calculator.

Many conventional loans are made with as little as 3 down. The program can be used to refinance a. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

The current maximum is 647200 in most US. At the end of the loan you have to either get another interest-only loan or you have to get a conventional loan. 045 percent to 105 percent depending on the loan term 15 years vs.

Active duty service members receiving Basic Allowance for. Conventional loans with just 3 down. The advanced options include things like monthly homeowners insurance mortgage interest rate private mortgage insurance when applicable loan type and the property tax rate.

Department of Vertans Affairs VA Loan. You can calculate your mortgage qualification based on income purchase price or. A loan calculator that easily calculates the payment amount or term interest rate or the amount you can borrow.

Why not a 30-year mortgage. While 20 percent is thought of as the. Use our home affordability calculator to find out how much house you can afford.

Since you have built no equity up to that point you can expect to have a. Factor in income taxes and more to better understand your ideal loan amount. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow.

The Conventional 97 program does not enforce a specific minimum credit score beyond those for a typical conventional home loan. That is IF you want a conventional interest calculation. Get A Custom Rate And Payment Quote On A New Mortgage.

Ad Make The Right Decision Using Our Mortgage Calculators And Homebuying Resources. That means for a first-time home buyer down. Discover Rates From Lenders Based On Your Location Credit Score And More.

Counties 970800 in high-cost areas. Removes PMI on a conventional loan. Calculate Your Home Loan.

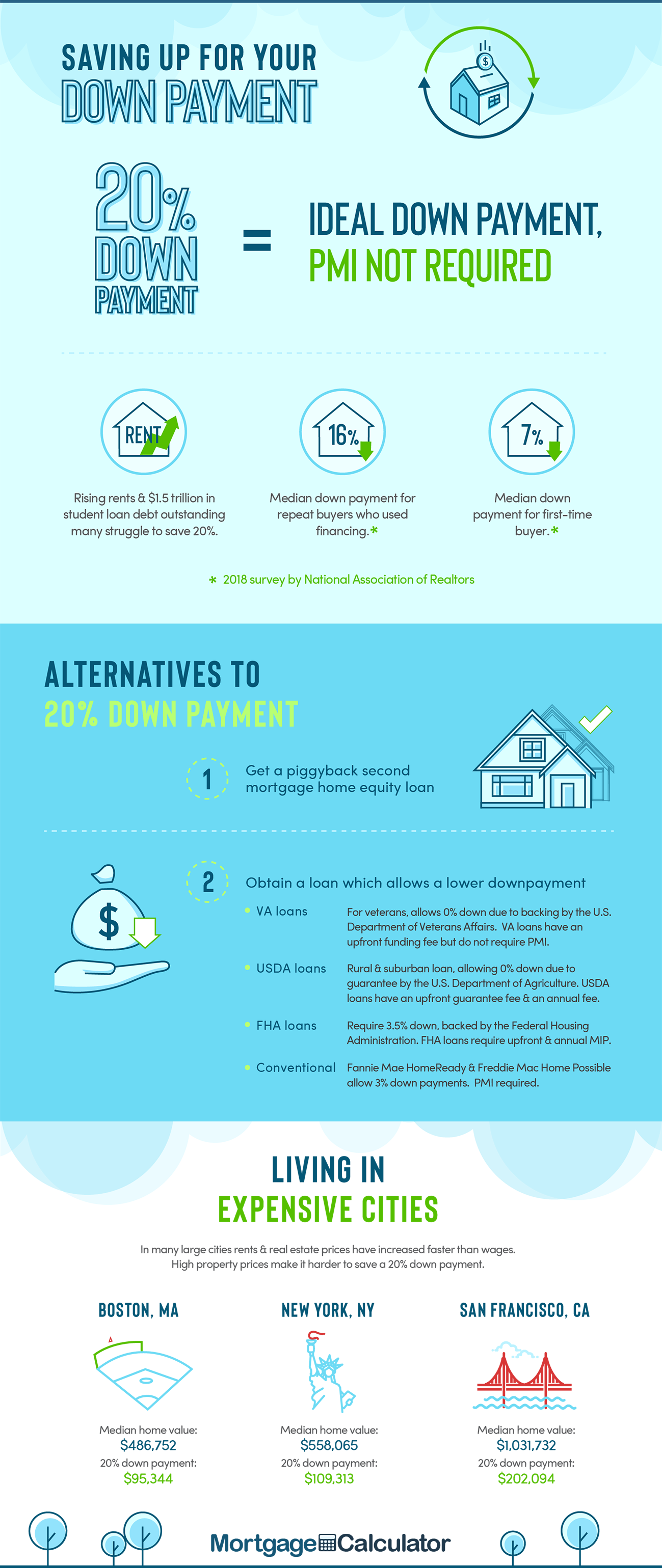

The standard down payment percentage is 20 however certain loans allow for a down payment much lower than that in some cases as low as 0 VA Loan or 35 FHA Loan. To calculate how much you can afford you need your gross monthly income monthly debts. Top-Rated Mortgages for 2022.

Lenders can count VA disability income and certain military allowances to determine how much you can borrow with a VA loan. Annual mortgage insurance premium. During a cash crunch or financial emergencies one can opt for a loan against their fixed deposit investment without breaking the FD.

30 years the loan amount and the initial loan-to-value ratio or LTV. How much can I. The HomeReady mortgage program is one such option.

Before applying for a mortgage you can use our calculator above. Check Your Eligibility for Free. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. This provides a ballpark estimate of the required minimum income to afford. Any borrower with a conventional loan who puts less than 20 down is required to buy private mortgage insurance PMI which raises the annual cost of the loan.

Rates are At a 40-year Low. For home buying the Rent vs. For 2021 the baseline conforming conventional loan limit for one-unit properties is 548250.

Most mortgages have a loan term of 30 years. The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance. If you cant afford a 20 down payment on your home and apply for a conventional loan youll have to have private mortgage insurance PMI to cover the costs or just plain.

4 Its called baseline because the maximum amountor limityou can borrow is. Ad Compare The Best Mortgage Rates. In many cases homebuyers can borrow up to 548250 with a VA loan but you may be able to borrow more in areas with a higher cost of living.

Buy Calculator considers one-time costs closing costs and the down payment and ongoing expenses like property taxes an HOA fee home insurance and. Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. With a loan against fixed deposit you can.

So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan. Since 2010 20-year and 15.

What Credit Score Is Needed To Buy A House Credit Score Credit Score Repair Improve Credit Score

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Key Players In The Home Buying Process Realestate Home Buying Process Home Buying The Borrowers

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Va Loan Pre Approval Process Va Loan Mortgage Loans Mortgage Loan Calculator

Biweekly Mortgage Calculator Mortgage Calculator Mortgage Payment Mortgage Payment Calculator

Mortgage Calculator How To Use One Lendingtree

Rates Have Started To Come Down Further And Are Quite Attractive But The Best Deals Imho Are Probably Months Awa 30 Year Mortgage Home Loans Mortgage Rates

Can I Afford To Buy A Home Mortgage Affordability Calculator

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Mapping The Mostly Huge Housing Price Jumps Across La Map House Prices Cheap Houses

Video 3 Conventional Home Loan Requirements You Need To Know Home Loans Conventional Loan Loan

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday

Self Employed And Hoping To Finance A Home What You Need To Know Profit And Loss Statement Personal Line Of Credit Mortgage Process

Historically Low Mortgage Rates Are A Big Motivator For Homebuyers Right Now In 2020 Alone Rates Hit New Reco Mortgage Interest Rates Mortgage Rates Mortgage

Home Loan Downpayment Calculator

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips